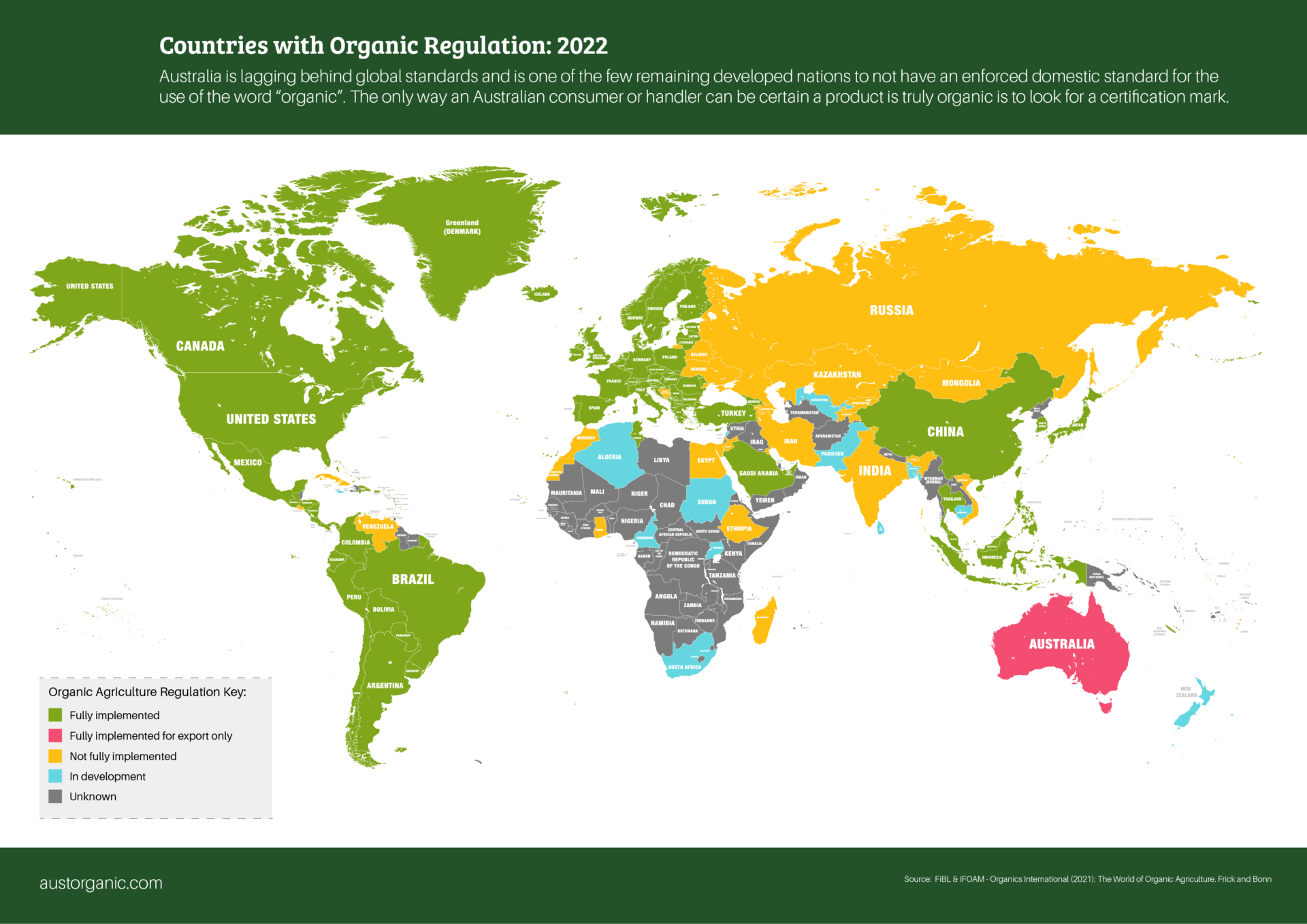

Australia is misaligned with global standards and is officially the last nation in the OECD to not have an enforced domestic standard for the use of the word “organic”.

It is Australian Organic Limited’s strategic priority to work with government and key regulatory bodies to deliver a fit for purpose regulatory process that is consistent with the organic export requirements.

This consistent approach to the organic industry will ensure Australia’s world-class organic standard will continue to grow market access internationally and provide Australian consumers with confidence when choosing products that claim to be organic.

Australian Organic Limited believes legislation is the best way forward for consistent domestic regulation of the Australian organic industry. The Statement of Support gives people in the organic industry, whether they are operators, consumers or other stakeholders, the opportunity to note the value of a suitable regulatory framework.

PricewaterhouseCoopers Australia (PwC) developed a survey for operators within the domestic organics market to establish a complete picture of the current market and its foreseeable future. A separate survey was also developed for consumers, to inform the benefits and costs captured as part of an economic analysis of regulatory options proposed for the organics market. Both surveys have now closed. Results were referred to as part of PwC’s cost benefit analysis, which can be viewed on the Department website here.

In December 2020, Minister Littleproud announced the Organics Industry Advisory Group (OIAG) bringing together sixteen organic industry representatives; from producers to manufacturers, consumers to small growers, certification and industry bodies; to assess whether the current framework was fit for purpose and recommend what consistent domestic regulation should look like.

After discussions between January and June 2021, the OIAG agreed the current regulatory framework was not fit for purpose and made clear recommendations to Minister Littleproud in a report on how the organic industry can reach its full potential delivered in June 2021.

On 26 November 2021, the Minister announced a Regulatory Impact Statement (RIS) as part of the next stage of reviewing and progressing the implementation of domestic regulation in Australia. AOL continued to work with the Government during this RIS process as part of the reconvened OIAG and provided advice to the Department of Agriculture and consultants from PriceWaterhouseCoopers on how to connect with industry stakeholders as part of the RIS.

Following the Minister’s announcement The Department of Agriculture, Water and the Environment conducted surveys with businesses, consumers and roundtables (which AOL participated in) throughout January 2022. When these surveys were complete the Department announced a consultation RIS which ran from 18 February to 17 March 2022. AOL provided a comprehensive submission on behalf of its members highlighting the need for domestic legislation of the National Standard.

As a member of the Organic Industry Advisory Committee, AOL and many of its members (Arcadian, Kialla, Angove Wines, The Organic Milk Co, Mallee Organics, ACO Certification, AUS-QUAL, Cullen Wines, Pure Harvest), worked closely with the Department to ensure the interests of the industry were represented through consistent, measured and future-focused outcomes. The OIAG has now concluded, consistent with its Terms of Reference.

For the Consultation RIS process that was open until 17 March 2022, the Department sought feedback from businesses and individuals across the organics sector on regulatory and non-regulatory options for Australia’s organic framework. The Department received over 80 submissions during this period. Based on feedback AOL received from the Department, submissions indicated a preference for a new regulatory framework.

The announcement of a federal election in April 2022 brought about a pause in the domestic regulation process, with Labor going on to claim government and the new Department of Agriculture, Fisheries and Forestry taking shape. Much of their focus following the election was on pressing matters related to flooding and biosecurity, but the industry managed to re-engage the organic discussion with the Department and new Minister for Agriculture Murray Watt later in 2022.

On 30 March 2023, more than 12 months after the Consultation RIS process concluded, Minister for Agriculture Murray Watt announced that the Australian Government will not progress a domestic regulatory framework for organics. The Minister stated that the “…costs would outweigh the benefits”, based upon cost benefit analyses (CBA) that were conducted regarding regulatory pathways. AOL published a media release on 31 March 2023 in response to this announcement.

Since this announcement, the Australian organic industry has continued to advocate strongly for a domestic regulatory structure that will support the future of the sector.

The Domestic Regulation Information Pack prepared by AOL is still relevant for any members who wish to contact their local member of parliament and raise the issue of the domestic regulation directly. AOL encourages everyone to email this pack directly to their local member, or else hand the pack over directly at any events where they are set to appear.

Please click here to access the pack.

At present, the only way an Australian consumer can be certain a product is truly organic is to look for a certification mark. There are currently five marks used within Australia, each mark is attached to a certification body approved by the Department of Agriculture, Fisheries and Forestry (DAFF) to the National Standard for Organic & Bio Dynamic Produce (National Standard or NS) under the Export Control Act (2020).

The National Standard, via the use of an Organic Goods Certificate (OGC), provides 81 countries with surety that the produce they are purchasing from Australia adheres to the rigorous certification and audit processes. However, within Australia there are variations of Standards that make the consumption and production of organic products difficult to navigate and results in confusion for consumers.

The National Standard was written with the intention to be enforced domestically as clearly stated by Mr Crean in a Ministerial Press Release, dated 10 February 1992 when the National Standard for Organic & Bio Dynamic Produce was released; “I therefore intend to request the new National Food Authority to take the necessary action to ensure the regulatory controls on the domestic market parallel those which I am implementing for export.”

The Standard was and remains world-class as stated by Mr Crean; “This is a hallmark achievement for the Australian organic produce industry which I understand has produced the first nationally agreed standard outside of the European Community.”

Australian Organic Limited is proposing that the National Standard be enforced domestically to provide confidence and a level playing field in a dynamic growth industry.

The 2023 Australian Organic Market Report provides insights on our strong and growing sector.

Despite significant growth, Australian consumers are still confused or fooled at the register on a regular basis due to multiple standards and the prolific growth of products simply claiming to be organic. While the ACCC is tasked with managing consumer deception, its limited resources are not keeping up with the fast-growing sector requirements and the opportunists that are watering down the organic standard.

The 2021 Australian Organic Market Report revealed that almost 9 in 10 shoppers did not know there was a single legal definition for the term organic in Australia. Our 2023 Market Report found that 33% of shoppers who purchased an organic product in the past year believe they have been previously misled by organic claims on product packaging.

In June 2020, Australian Organic Limited submitted, on behalf of its members, a discussion paper outlining the opportunities for future economic and industry growth should a mandatory domestic standard be implemented. Providing consistency in both markets will allow discussion of equivalency to progress with confidence as international stakeholders have provided comments that this discrepancy limits trust in our exports.

We continue to support the co-regulatory model for the maintenance of the standard and certification program that underpins the organic industry.

“One of the biggest impediments to the export of Certified Organic product from Australia is our lack of equivalency with chief markets, with a significant obstacle to us achieving equivalency being our lack of organic domestic legislation.

To enable us to achieve our primary objective, we must first achieve implementing a domestic standard. We hope to effect this change by having the National Organic Standard introduced into the legislative framework.

AOL is working with Government and Industry to provide a pathway for the implementation of a consistent domestic standard. It is worth noting that the single biggest competitor to organic products domestically is “fake organic”. A mandatory domestic standard will not only significantly increase exports for Australian Organic businesses, it will also remove the biggest competitor in their local market.”

Martin Meek

Former Chairman, Australian Organic Limited

Australian Organic Limited (AOL) is the peak body for the organic industry.

AOL acknowledges the Traditional Custodians of the land on which we operate, the Turrbal and Yuggera people. We extend our respect to Elders past, present and emerging.