Welcome to the Australian Organic Market Report 2021, the only Report of its kind in Australia presenting the latest data and information available on the Australian organic industry, an industry that contributes over $2 billion annually to the national economy.

In collaboration with the University of Melbourne and research partners Euromonitor International, Mobium Group, and NielsenIQ, this year’s Report presents findings and insights into Australian organic operations, domestic market value, Australian organic shoppers and households, and the international organic market.

The Australian Organic Market Report has served as an important resource for industry professionals, institutions, key stakeholders and government departments for more than a decade. The Report is often referenced as the go-to resource for information surrounding the Australian organic industry and has supported the development of key activities within the sector, including the pathway towards a mandatory domestic standard.

With thanks to the University of Melbourne, our research partners, and certification bodies ACO Certification Ltd and AUS-QUAL for providing key industry data that made this Report possible.

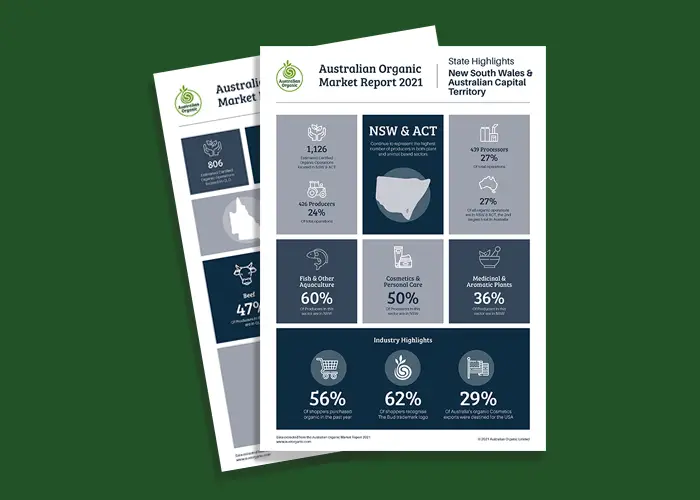

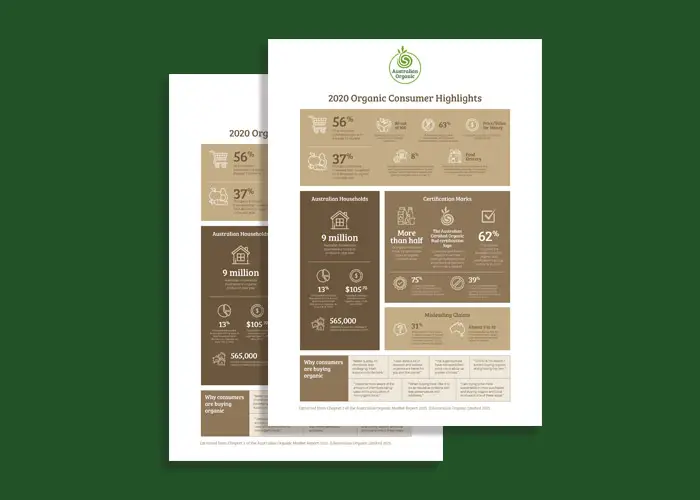

62% of shoppers recognise the Bud certification logo (up from 51% in 2019).

37% of organic shoppers increased their household food allocation to organic in 2020.

The number of certified organic operations in Australia has grown by 38% since 2011.

63% of shoppers believe that ‘Chemical-free’ is the primary perceived benefit of organic products.

Our nation’s organic industry currently contributes over $2 billion to the nation’s economy every year.

Were the leading export destinations for Australian organic exports in 2020.

Despite recent global and climatic events, Australian organic exporters continued to successfully reach 62 international markets during 2020.

The total value of the organic industry in Australia has grown significantly year on year. Be a part of this growing industry by becoming an Australian Organic Member. Australian Organic members receive a complimentary hard copy of the Australian Organic Market Report 2021.

The Australian Organic Market Report 2021 publication is copyright. Save for any use as permitted under the Copyright Act 1968 (Cth), all rights are reserved.

Any requests to access a full digital copy of this document, or enquiries concerning reproduction of this material, should be communicated to Australian Organic Limited on (07) 3350 5716.

Our AOMR Digital Supporter Kit includes a range of social media tiles so you can share insights from the Market Report on your own social media platforms.

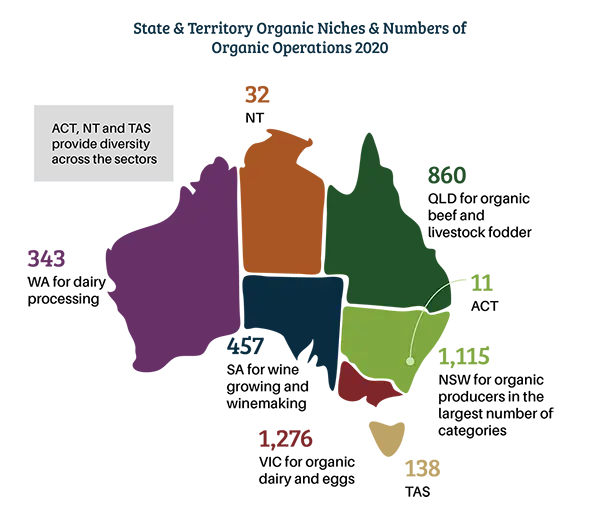

Download individual State Highlights which include key information for each Australian State and Territory from the Australian Organic Market Report 2021.

Download the Consumer Highlights for the Australian Organic Market Report 2021, with an overview of Australian organic shopper behaviour.

Welcome to the first Australian Organic Market Report 2021 Industry Research: Volume 1.

In collaboration with the University of Melbourne, Australian Organic Limited is working towards developing a range of insightful research to support the growth of the industry.

Volume 1 consists of a literature review into the benefits of organic products versus conventional, across six food categories: dairy, cereals and grains, fruits and vegetables, meat, wine and fermented foods. The findings of the review highlight clear pathways for new and future research opportunities, building upon research currently available.

To download a digital copy of the Research Report, register for free via the link below.

AOL members receive a hard copy of the Report, with digital copies available in the AOL member portal here (login required).

Australian Organic Limited (AOL) is the peak body for the organic industry.

AOL acknowledges the Traditional Custodians of the land on which we operate, the Turrbal and Yuggera people. We extend our respect to Elders past, present and emerging.

"*" indicates required fields

"*" indicates required fields